Chamberlain McBain News Blog

Anna’s blog: Prime Minister Reassures the Nation After Shock Rate Rises

Supporters of the Prime Minister said that he has lots of experience

because he is the former Chancellor of the Exchequer. He was certainly looking to convey his financial acumen and was careful to pay great attention to detail. Of course, at this

time of uncertainty and all of the bad press facing the Conservative party, he is looking to build trust in the public as he promises that he can bring down the Bank of England

base rate and price growth.

Supporters of the Prime Minister said that he has lots of experience

because he is the former Chancellor of the Exchequer. He was certainly looking to convey his financial acumen and was careful to pay great attention to detail. Of course, at this

time of uncertainty and all of the bad press facing the Conservative party, he is looking to build trust in the public as he promises that he can bring down the Bank of England

base rate and price growth.

2023 Promises

It was only in January this year that Richie Sunak made promises during his primary pledge to half the inflation from 10% at the time down to around 5% by December. Yesterday he said, "Yesterday, you would have heard some news about inflation; today, you may have seen what the Bank of England has announced with interest rates. I'm sure that actually fills many of you with some anxiety and some concern about what's going on and what that means for you and your families. I'm here to tell you that I am totally, 100%, on it, and it's going to be okay, and we are going to get through this."

Re-election Chances

When he finished his speech and opened the floor to questions, Sky News wanted to know if he thought his electoral chances were being harmed by his approach to the economy. So far, he has shied away from any tax cuts, kept public pay low, and has made promises to have inflation; however, he did not seem to think it was a huge problem or would damage his re-election chances. He conceded that hitting his own target was now more difficult, but he still felt it was manageable, not impossible.

Halving Inflation

Unsurprisingly, the economy is pretty much all he gets to talk about these days and soon after the interest rate hike. He was being interviewed by the Times CEO Summit. He was stoic in his commitment to halving inflation by the end of the year and confirmed that he always knew it would be a mammoth task.

Labour Responds

The opposition leader, Sir Keir Starmer, was at a by-election campaign event, coincidentally in the former constituency of Boris Johnson. He said, “The government wants to pretend it is someone else’s fault. You have to ask the question why the UK is always hit the hardest - and the answer to that is 30 years of absolute failure from this government, a kamikaze budget and a failure to fix the fundamentals,"

Anna’s blog: Jeremy Hunt Says No Alternative to Increasing Interest Rates

It is the opinion of the Chancellor of the Exchequer, Jeremy Hunt, that

the UK has been left with no choice but to increase interest rates to try and stop the prices from rising so rapidly. He spoke of the challenge that we face with price rises and

confirmed there was no alternative but to increase interest rates but stated that the government would be unwavering in its support of the Bank of England as they work together to

do whatever it takes to slow down inflation.

It is the opinion of the Chancellor of the Exchequer, Jeremy Hunt, that

the UK has been left with no choice but to increase interest rates to try and stop the prices from rising so rapidly. He spoke of the challenge that we face with price rises and

confirmed there was no alternative but to increase interest rates but stated that the government would be unwavering in its support of the Bank of England as they work together to

do whatever it takes to slow down inflation.

April Economic Growth

The April UK economic growth was largely dominated by rising interest rates and the cost of mortgages. Although there was a 0.2% growth in the economy, The Office for National Statistics said it had been a poor month for estate agents and house builders. The cost of borrowing has been only increasing since December 2021 and currently stands at 4.5%. These rises were an attempt to slow down consumer price inflation, but this is currently 8.7%. The Bank of England's inflation target was only 2%, so this figure is dramatically inflated.

A Rise in Interest Rates

The idea behind bringing interest rates up again means that borrowing is more expensive, and people will have less expendable income, which in turn will mean fewer things get purchased, and this slows rising prices. Technically it benefits savers, but only if banks choose to pass on these rates to their customers, and it negatively impacts mortgages, credit cards and loan payments because the interest rates will be higher.

The Bank of England

In 1997, the Bank of England was declared independent, and this means that since then, the UK government does not get a say in how interest rates are set. Hunt said, "In the end, there is no alternative to bringing down inflation if we want to see consumers spending if we want to see businesses investing, if we want to see long-term growth and prosperity." In April, there was some expansion of the economy in the UK after a 0.3% shrinkage in March. Over the three months to April, it had grown, but only marginally at 0.1%.

Hospitality Industry

The Office for National Statistics presented a mixed bag saying that the construction sector had definitely suffered because interest rates were rising, and this, combined with mortgage rate costs, meant that fewer people were buying houses and instead exercising caution. It also doesn’t help that as fixed-rate mortgages come to an end, lenders are withdrawing, some products leaving homeowners with less choice. It’s not an easy time for first-time buyers, either, as they have higher interest rates, meaning they cannot afford to proceed with the mortgage, and even landlords are facing having to sell their properties which are impacting those renting from them. HSBC, who is one of the most significant UK lenders, withdrew the new residential mortgages that they would normally supply via brokers. Conversely, in the hospitality sector, bars and pubs saw a very strong trade which helped to boost growth.

Anna’s blog: Mortgage Holders Braced as Higher Rates Lead to Recession

As many mortgage holders reach the end of the fixed rate period, Britain

will be tipped into a recession by the soaring mortgage rates as homeowners struggle to refix a deal that is affordable. This stark warning has come from Moody’s, the leading

ratings agency.

As many mortgage holders reach the end of the fixed rate period, Britain

will be tipped into a recession by the soaring mortgage rates as homeowners struggle to refix a deal that is affordable. This stark warning has come from Moody’s, the leading

ratings agency.

Global Technical Recession

It is not just the UK but Germany and the USA that are predicted to hit a technical recession, but it will only be the UK that records negative growth for the year. This is further evidenced by the Bank of England, which issued a statement saying it has become incredibly challenging to get control of price rises because of the persistent underlying inflation compared with other countries.

Fixed Rate Mortgages

A large percentage of British homeowners are on some kind of fixed rate mortgage deal, but it’s likely to only be short term, and this leads to a vulnerability for recession. At least half of those with mortgages will find themselves having to accept a floating rate or will have to fix a deal at a much higher rate in order to continue. This will have a negative impact on the disposable income of a typical household.

In the UK, fixed-rate mortgage deals tend to only be offered for periods of between two and five years which, compared to Germany and America, is incredibly short. Their fixed rate deals are much longer with Germany, generally giving 10-year fixed rates and the US offering 30-year fixed rates, which means a lesser percentage of homeowners are going to be affected by rate rises because they are fixed and have been for many years.

GDP to Shrink

The knock-on effect means that in the UK, the GDP is predicted to shrink by 0.1% over 2023. This is one of the biggest falls in the G20, with only Argentina and Russia predicting worse. And the bad news just keeps coming. Looking at figures since the pandemic, when moving was banned, the current data shows house sales are at their lowest level even now. In April 67,220, residential sales were registered according to HM revenue and customs. This figure is down 29% when compared with the previous month, making this the lowest for three years.

Mortgage Rates

This is all tied in with the mortgage rates; before the mini-budget in September, an average fixed rate deal of two years was just 4.7%, but this climbed rapidly in just four weeks to 6.65%. With house purchases taking on average around five months to complete from the sale agreed, there is a delay in the effects, which are now spiking.

The European Central Bank also issued a stark warning that interest rates climbing would test the resilience and potentially raise the risk of disorder of Eurozone households and companies across all markets. They also spoke of the concern that weakness had been revealed during the fight against inflation, showing vulnerabilities in the financial system that cannot be ignored, which they feel is very concerning.

Anna’s blog: UK Sees Stronger Economy in January Than Expected

The UK economy got an unexpected boost in January thanks to a massive influx

of self-assessment tax payments. Despite increased spending to help the most affected households with energy bills and EU payments, there was a notable surplus of cash available

for the government to spend at the end of January 2023. Naturally, good news like this warrants discussion.

The UK economy got an unexpected boost in January thanks to a massive influx

of self-assessment tax payments. Despite increased spending to help the most affected households with energy bills and EU payments, there was a notable surplus of cash available

for the government to spend at the end of January 2023. Naturally, good news like this warrants discussion.

Self-Assessment on the Rise

If we take a look at the data, we can see that the favourable financial position the government is currently in is thanks to the increase in money from self-assessment tax returns. The number of people who paid their self-assessment tax bill is the highest since 1999 when official record-keeping began.

The result was that the government spent less money than was paid in tax, leaving them a £5.4bn surplus which could be used for other projects or simply investing back into the economy.

Incoming Budget

Despite this surplus of cash, official figures suggest that the UK is still heading for a recession, and it is unknown how tax and spending will be affected by the budget that will be delivered next month on the 15th of March by the Chancellor.

Generally speaking, experts predict that the budget may be a positive one, as the cost of wholesale energy has gone down, which means that government support for bill support will only need to be a fraction of what it was forecast to be last year.

In fact, public borrowing for the financial year just gone is £30.6bn less than was officially predicted by the financial experts. This is good news and points to the economy doing better than was initially perceived.

Wait and See

Unfortunately, it's too early to tell if we can begin to reverse the damage from the last few years any time soon. Short-term changes to the U.K.’s financial situation are not as important as some would hope, and we will need to see constant positive financial updates for at least six months before we can begin to say with any certainty as to whether or not things will improve.

Despite this, the increase in government funding available for January is a cause for celebration. It suggests that not only are our businesses profiting and generating a high turnover, but it also suggests that a lot of people are creating lucrative business opportunities for themselves, which can help a lot with the current job and wage shortage.

Final Thoughts

So, it’s clear that the projections for January were better than we expected. This is no bad thing and does point to what will hopefully be continued growth for the country. Obviously, it is a little too early to tell what will happen to the economy right now, but with a little bit of time and continued financial success, we could be in for a shorter recession than what was first predicted. For now though, it’s worth waiting and seeing what will happen.

Anna’s blog: UK Inflation Slows, But Prices Near 40-Year High

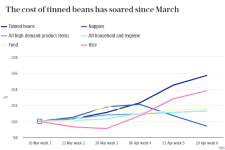

Food costs continue to increase in the UK, fuelling the inflation rate and

driving up the overall cost of living. There has been a notable increase in sugar, olive oil and low-fat milk prices.

Food costs continue to increase in the UK, fuelling the inflation rate and

driving up the overall cost of living. There has been a notable increase in sugar, olive oil and low-fat milk prices.

The current inflation rate for food is currently at a 45-year record, and some supermarkets have warned that prices will continue to stay up throughout the year in recent projections.

Inflation Falls Slowly

The overall inflation rate for the UK fell for the third month in a row since December. In January, it was 10.1%, down from 10.5%.

The main factors which slowed down the inflation rate were the decreases in fuel prices and the reduced cost of dining in public.

Inflation is measuring an increase in the price of something over time. In order to calculate what the current inflation rate is, the Office for National Statistics tracks the prices of hundreds, if not thousands, of everyday items.

If these rates fall, then it doesn’t mean that the prices of certain goods are going down but that the price is rising slowly. The general consensus is that inflation will continue to fall for the next year, but it is currently at five times the target of the Bank of England, which sits at only 2%.

An Uncertain Future

The future of the economy is currently uncertain. It isn’t easy to know what will happen in the future and how these events will impact the rest of the year. At the moment, inflation rates are falling slowly, but this could easily change.

Obviously, it’s important to remain fluid in the face of uncertain circumstances. We must be able to adapt and change to our environment, making sure that we make decisions that will ultimately give us some level of financial freedom.

We recognise that it’s difficult to try and prepare for the future when we don’t know what’s going to happen. However, if there is one thing we can say about the economy at this time, it’s still relatively unstable. It would be unwise to make any assumptions about what the future will bring or your ability to deal with it. The best thing that you can do is try and prepare vigilantly for everything.

Hopefully, this is the beginning of a return to normality, and the recession will end fairly soon, but it’s difficult to know with any real certainty. The best thing we can do is try and hope for a smooth transition back towards normality.

Final Thoughts

The continued fall of inflation rates is in line with what’s been predicted by financial experts since the beginning of the year. However, only time will tell as to whether or not this is going to be possible. The best thing that we can do is try and prepare for any eventuality, which means that we will need to work slowly and carefully to build up cash reserves and pay off any debt while we can.

Anna’s blog: Is the Recession Already Here?

We’ve all been living and waiting for that dreaded day that the recession

is announced. It seems like it’s an almost inevitable eventuality at this point. However, nobody considered the quietly terrifying prospect that the recession might already be here

and that we just don’t know it yet. However, somebody who used to work for the Bank of England thinks that it does already live among us, and it’s interesting to think about.

We’ve all been living and waiting for that dreaded day that the recession

is announced. It seems like it’s an almost inevitable eventuality at this point. However, nobody considered the quietly terrifying prospect that the recession might already be here

and that we just don’t know it yet. However, somebody who used to work for the Bank of England thinks that it does already live among us, and it’s interesting to think about.

The Quiet Emergence of Economic Crisis

Danny Blanchflower is a former rate-setter for the Bank of England. He recently came out as saying that:

“The UK in all likelihood is already in recession. The right thing to do is to sit back and wait and watch as the global recession probably spreads”.

Well, that’s definitely an interesting, if slightly bleak, take on things. The idea that the recession has already arrived and that there is very little we can do about it besides brace for impact is quietly quite depressing.

Economists predict that our GDP shrank 0.5% during the second quarter, so it’s not exactly difficult to imagine that we have been falling into economic problems, but the idea that the recession is already here is quite upsetting for some people.

Dark Times Ahead

It’s looking like it’s going to be a very difficult winter for a lot of reasons. Current economic predictions suggest that energy bills could rise to £3800 by the winter, which is a disturbing amount of money. Lots of people will simply not be able to afford this, and there are even rumblings that electricity will have to be rationed across the country.

Functionally, we are sailing into some very dark times, and the result is going to be deeply disturbing if we’re not careful. The economy has had ups and downs throughout the year, but it’s primarily not been doing that well. The overall consensus is that we need strong and swift action to try and reverse course, but many take the idea that we can’t do anything about it anymore. We are going to crash into a recession whether we want to or not.

Ultimately, it’s just a case of bracing for impact. After all, there are plenty of situations where the economy could improve, but we just have to be prepared to face the worst if it comes.

Final Thoughts

So, the idea that we are plunging into an economic recession and that it is, in fact, already here is quite upsetting.

Ultimately, people have a responsibility to try and make sure that they put aside some money to brace for a difficult winter. Naturally, the more money that we can save for ourselves, the better it will be. However, there is going to be a sharp rise in energy bill prices, and a recession could well be inevitable. Unfortunately, we’re just going to have to wait and see what happens and deal with each new challenge as it presents itself.

Anna’s blog: Here Comes the Recession

The word “recession” is one that we’ve been dealing with for a while now. There have been rumblings of a recession for quite some time, and people are getting a little bit nervous at the idea

However, as the economic situation in the country continues to get worse, people are beginning to get more restless. It seems like the idea of a recession is getting closer and closer, and there doesn’t seem to be much we can do about it.

Heading For Problem

At the end of the day, one of the big things that we can’t get out of is that the economy has not been doing so well all year. It’s hard for people to try and look at the big picture, which is concerning.

Most of us are trying to ignore the fact that there have been rumblings of a recession in the autumn and winter. However, according to the latest financial reports, it’s pretty much unavoidable now.

We are in a situation where it’s looking increasingly likely that we will have to deal with a recession. The economy is slowing down more every month, and a lot of the backlog from the pandemic has been fulfilled now. There is no more artificial boosting of the figures, so the reality of what’s actually being spent on a week by week basis is hard to wrap our heads around.

Preparing For Hardship

There is no doubt that the government is probably working very hard to try and prepare a solution to avoid the recession, or, at the very least, work out a way to reduce the impact. However, it’s not as straightforward as that. We are in a situation where it’s going to be difficult for people to approach the recession with confidence, so now is the time to make those final spending changes.

For example, we are beginning to see people spend less on the weekly food shop, or less on entertainment. This will only get more prominent as time goes on, so it’s very important that you try and practice being frugal and financially savvy to avoid being at a disadvantage when the recession does set in.

We are definitely going to need more government support, but whether or not we get that remains to be seen. It’s just going to be a case of waiting and seeing what happens, which is difficult to think about, but unfortunately just part of the process.

Final Thoughts

The recession is probably going to happen now, and that’s difficult for people to accept, but we just have to try and look at it as best we can. There’s not going to be a lot we can do besides grit our teeth and deal with things, so it’s ultimately just about trying to prepare. Maybe the rest of the summer will be more positive, we do have a few more months of good weather ahead of us, and the tourism industry might help, but it’s just a case of riding out the bad times for a bit.

Anna’s blog: UK Bound For Recession - So Says Lord Hammond

The former chancellor, Lord Hammond, has recently weighed in on the

current economic situation and is sharing the same sentiment echoed by many of our experts - the autumn is going to be a rough, challenging time regarding the economy

The former chancellor, Lord Hammond, has recently weighed in on the

current economic situation and is sharing the same sentiment echoed by many of our experts - the autumn is going to be a rough, challenging time regarding the economy

As the former chancellor, Lord Hammond has some interesting opinions, and they are worth listening to, so we thought we would summarise what he said for you, and see if we can’t divine the meaning from it.

Recession Inbound

So, in a recent interview, Lord Hammond recently talked a little bit about the COVID-19 pandemic and how it influenced the current economic situation, saying that:

“To think that we can somehow move on from that, leave the tab on the table and act as if nothing had happened is unrealistic, is naive.

There's now got to be a part of the cycle where we correct for the extraordinary action that was taken during the pandemic.

And a lot of what we're seeing at the moment in terms of inflation pressures in the domestic economy is a result of the people having saved quite a lot during the lockdown period and that saving getting released into the economy over the last six months."

Actions Have Consequences

Functionally, what we’re dealing with right now is the basic idea that actions do have consequences. The coronavirus pandemic did require a massive government response, and, credit where it is due, they really did step up.

However, these kinds of actions do have a consequence. The massive economic drain that we put on the country trying to keep everybody safe during the pandemic, whether it was the grant scheme or paying for the vaccine to be created, all the rapid testing, it’s had an impact. We were warned ahead of time that there would be consequences, but nobody really expected that they would come now, or that they would come in the shape that they have.

We are now seeing the full consequences of the pandemic, and it’s pretty grim. We are heading for a recession, and to be fair, a lot of countries might well be in the same position as we are within a year or two, but we are one of the first to really experience severe financial consequences. It’s definitely important that we try to look towards the positives, and work out how we can make changes moving forward.

Final Thoughts

Ultimately, it seems like a recession is, for the most part, completely unavoidable. We were warned there would be consequences to our decisions, and the result has proven itself to be substantial. We are definitely living in a period where it’s about to get much more difficult financially, and whether or not we want to face that, it is going to happen. It’ll be tough for the government to provide a comprehensive solution that prevents the problem altogether, but we just have to wait and see what happens.

Anna’s blog: The UK Economy - Stopping, Shrinking, and Slightly Going Wrong

As is often the case with the UK economy, we are beginning to see things

go a little bit wrong again. It’s not exactly been the most productive year for anybody, and we’ve had to watch the economy slide further into problems, but the latest advice and

predictions are not looking great. Instead, we thought we were told a little bit about it because, let’s be honest, everybody is concerned right now.

As is often the case with the UK economy, we are beginning to see things

go a little bit wrong again. It’s not exactly been the most productive year for anybody, and we’ve had to watch the economy slide further into problems, but the latest advice and

predictions are not looking great. Instead, we thought we were told a little bit about it because, let’s be honest, everybody is concerned right now.

Grinding to a Halt

The first big problem that will likely occur is that the UK economy is going to grind to an effective halt. We’ve been watching reports for quite some time now that the economy is plunging further into a bad place, and economic growth each month hasn’t been as high as what was projected. The end result is that eventually, there isn’t going to be any more growth. It is predicted that we will simply grind to a halt. If there is no economic growth to try and match the rising inflation costs and rates of interest, then we are in a difficult position.

The Shrinkage

The biggest problem that we are facing after the grinding of the economy to a halt is shrinkage. Once the economy stops growing, one of the things that can do a start to shrink. This means that we’re not actually making growth; we’re going backwards. This would be a very problematic situation because interest rates are rising, inflation is rising, and the threat of a recession is getting closer and closer. It’s difficult to determine exactly what we can do about the situation, but shrinkage is a growing threat.

An Uncertain Future

Unfortunately, the future that we live in is now quite uncertain. Nobody knows exactly what will happen in the future, but it is not looking good. If the economy does stop growing and shrinkage occurs, then a recession becomes even more likely.

The last recession was incredibly damaging for the economy, and we were back on track to do really well until the pandemic hit. Unfortunately, the COVID-19 pandemic, coupled with the conflict in Ukraine, has done nothing but make things harder. We will have to wait and see as to whether or not the government unveils more support, they are committed to a flexible support scheme, but only time will tell.

Final Thoughts

So, when it comes to the economy, we are not looking like a strong country right now. Things may get a lot worse, and with the threat of a recession and the energy bill rising still to come in the autumn, it could get very difficult. We will have to brace and hold ourselves ready for whatever may happen because there is no telling just how bad this will get until it actually goes off. The only thing that we can do, the most important thing that we can do, is to try and come up with methods to deal with these challenges. We need the government to help, essentially, and this may take time, but it’s worth it if they are prepared to deliver a robust support scheme.

Anna’s blog: Economy Recap - All Quiet on the Front

It seems like every week, we talk about something new when it comes to the

economy. Every week there is a new disaster, a new revelation that threatens to spill out into the world and cause major damage to our country. However, for once, that doesn’t

exist.

It seems like every week, we talk about something new when it comes to the

economy. Every week there is a new disaster, a new revelation that threatens to spill out into the world and cause major damage to our country. However, for once, that doesn’t

exist.

The battlefield of the UK is empty for once, no new threats marching in from the horizon. We’re waiting for a new problem to emerge now, for something fresh to turn up, and while we do, it’s important to take a moment and reflect on how we got here.

Errors Stacked on Errors

The reason why we’ve had such a problem is obvious to anyone - the long series of errors that have marked out the UK economy. It is not difficult to see that when it comes to the economy we’ve had a pretty bad hand, all things considered. There have been setbacks following our exit from lockdown, the crisis in Ukraine has forced prices up, and it’s generally been one long series of comedic errors.

Naturally, a situation of this kind is going to be difficult for anyone to deal with because it pushes people into situations where staying economically afloat is harder and harder. We’re in a sort of crisis situation, and it’s clear that the recent developments have done little but throw fuel on the fire.

Waiting For the Dawn

Unfortunately, we are in a position right now where the most we are able to do, seemingly, is wait for the next situation to occur. It seems like we are often stuck waiting for the next problem. Each week seems to bring a fresh challenge, and it is strange to not have one to report on.

Everybody wishes to see the situation improve. However, the reality is quite disappointing. It is unlikely that things will take such a radical U-turn, which means that instead, we will simply learn to adapt to the changing economic situation of the country. Perhaps we will see things get easier if the government produces more support schemes, but regarding the overall state of things? There is very little that can be done.

In this moment of brief pause, it is a good idea to look at the way we handle things. Are you approaching financial decisions sensibly? Are you remaining calm when talking about money? It’s important to develop a good attitude towards these things, especially when difficult times come around.

Final Thoughts

Ultimately, there’s very little we can do right now besides brace. It’s hard to know exactly how things will play out, but it’s safe to say that there are many different situations where things become more challenging. We have to hope that the government will continue to provide a robust support system and that the financial challenges that we face every day continue to remain as low as possible. At least nothing serious is happening right now, which means for a minute, we do have room to breathe.

Anna’s blog: Government Unveils More Measures to Help Combat Energy Price Rising

With the rise of energy prices becoming a real problem, it was only a

matter of time before the government developed a support package to pitch in and help out the most vulnerable in society. We all knew it was coming, which meant that when it did

turn up, it was a welcome relief.

With the rise of energy prices becoming a real problem, it was only a

matter of time before the government developed a support package to pitch in and help out the most vulnerable in society. We all knew it was coming, which meant that when it did

turn up, it was a welcome relief.

Recent announcements have given us a little bit of optimistic hope for the future, especially when you consider that there are now support packages in place to deal with the projected hike that will take place in the last quarter of 2022. Let’s take a bit of a look at what’s going on and highlight the support the government is prepared to put in place.

Financial Aid Inbound

So, the recent announcements that took place in the week boil down to providing financial aid for those that needed it. Every household will receive a £400 package to support their energy bill costs. The most vulnerable members of our society, those who are on the benefits system, or anybody who qualifies, will receive an extra £650 as a payment paid out in two lump sums.

It’s a pretty generous package and is being funded by a windfall tax on the fuel sector.

Support For Hard Times

It’s pretty safe to say that this is so much needed support for difficult times. We live in a period where economic uncertainty is constant. Nobody knows if they’re going have enough money to make it through the day, which is really scary when you’ve got a family to look after or bills to pay. The support package that has been put in place is definitely needed because it gives us the chance to take stock of what’s going on and make some smart decisions.

Ultimately, this package may well evolve with the times. The government has said that as the situation develops, more support may be unveiled, so it’s just a matter of time until we see how everything is going to work. It’s important to acknowledge that when it comes to ongoing support, we need to keep trying to save money regardless. There is no guarantee of a support package from the government, so we do have to be vigilant even when things look better. It’s about taking personal financial responsibility.

Final Thoughts

So, the recent support package that was announced is definitely helpful. We definitely needed some assistance from the government to get us through the hard times that are soon to come. Obviously, the support that we do receive will evolve over time. It’s important to acknowledge that the government is committed to helping where it can.

People can take a certain amount of personal responsibility for their finances. At the end of the day, try and avoid impulse spending. Remember that there is no guarantee we’ll have the money we need. Therefore, it’s never been more important to be vigilant.

Anna’s blog: Inflation - The Constantly Rising Headache

Here’s the thing, we don’t actually want to sit and talk about the

economy until the end of time, but it’s really becoming a problem at this point. Nobody can deny that the inflation issue that we’ve been facing for the last few months is getting

out of hand, but it’s just starting to break even more records, and it’s important to know what’s going on because it paints a rather sobering picture of life in the next year or

two.

Here’s the thing, we don’t actually want to sit and talk about the

economy until the end of time, but it’s really becoming a problem at this point. Nobody can deny that the inflation issue that we’ve been facing for the last few months is getting

out of hand, but it’s just starting to break even more records, and it’s important to know what’s going on because it paints a rather sobering picture of life in the next year or

two.

Dangerous Inflation Levels

The big problem that we’re having right now is that inflation levels are rising at a speed that we haven’t actually seen for 40 years. The current rate of inflation is 9%, which is rather high and very concerning.

Financially, we could not be in a worse position right about now. We are sliding towards a recession in the latter half of the year, and government support packages are not doing any good at all, and they are in short supply anyway. Some people are looking at a £700 increase in their energy bills, which is scary if you are living on a regular salary because where does the extra money come from?

Something Has to Give

The big problem that we are facing is that the position we’re in right now is currently rapidly becoming untenable. It’s just not going to be possible to maintain this level of high inflation rates and rising costs for much longer because there’s just not enough money to go around. It’s a rather concerning situation because it doesn’t appear to have a distinct endpoint. We could carry on like this for at least another 6-7 months, and if that is the case, what’s going to happen to people's ability to live?

Everybody is looking to the government to do something about the situation right now, but we haven’t had any big announcements yet. We did have some announcements back when the budget was released, like the promise to curb the amount of national insurance tax that somebody has to pay up to a certain point and providing a rebate on council tax, but there’s been nothing new to meet the ongoing developments.

With the conflict in Ukraine still ongoing, and the gap between wages and bills getting high all the time, it makes logical sense for the government to do something now, but we haven’t really seen anything in that vein just yet.

Final Thoughts

So, with the advent of inflation rising faster than it has done for the last 40 years, it’s become clear that we are rapidly developing into a situation which cannot be easily recovered. We need swift action very soon if we’re going to stand a chance of getting things back on track, which means the government really needs to announce some concrete plans to tackle the problem. Ultimately, this is a difficult period for people economically, and it has never been more important to be smart with money, trying to save it where you can.

Anna’s blog: Recession Fears on the Horizon - Tough Times Ahead?

The economic recession of the UK was a documented, well-known event for

many years. Everybody fears it happening again, and in this case, we might well be about to see it come true.

The economic recession of the UK was a documented, well-known event for

many years. Everybody fears it happening again, and in this case, we might well be about to see it come true.

The impact of our already fragmented economy has led to a rise in the number of consequences. The economy is shrinking, spending is going down, and interest rates are going up. A total crash seems to be inevitable, and it might happen sooner than you’d think.

Higher Prices Taking Their Toll

The rise in prices is beginning to showcase the current state of affairs in the UK, with people having to spend less and cut down on overall costs to try and mitigate a lack of income. Car trips are becoming increasingly difficult, for example, due to increasing fuel costs.

High-energy bills that began in April are also concerning, and their true impact has yet to be seen, but there’s every evidence that it will be incredibly difficult to keep up with them.

During the first three months of 2022, the economy grew by 0.8%. However, in March, it shrank by 0.1% as people began to spend less.

The Recession Imminent

The biggest boost to the economy came during the month of January. Both the travel and the hospitality industries finally began to recover from the restrictions put in place by the pandemic.

The resulting boost, however, was short-lived. The conflict in Ukraine had consequences, and households across the country began to feel higher prices creeping in.

As a result of all of these factors, the risk of a recession has risen, with many experts believing it will occur in the last few months of 2022 when problems hit an effective breaking point.

Can Anything Be Done?

Naturally, with such rumours on the horizon, people will be concerned and will want to know if we can prevent this future.

Unfortunately, from a purely economic standpoint, there isn’t anything the public can do. It is down to the government to design and introduce some kind of aid, and that is always going to be hard. They have to balance the future with what’s going on right now, and it is a challenge. However, there have been whisperings of more support, so we’ll just have to wait and see. It would definitely be appreciated and much-needed.

Final Thoughts

So, when it comes to the imminent threat of recession, there are a lot of considerations to keep in mind. It is important to keep in mind that there are many different considerations in play when a recession happens, and it is by no means guaranteed. Essentially, it’s a rumbling, and things can change, but it is important to know what’s happening. There are so many different scenarios that can occur, but what is important is that we brace for impact. The storm is coming metaphorically, and it could be a very difficult time for many people. We’ll just have to wait and see.

Anna’s blog: UK to Have Slowest Growth of G7 Nations

Watching people try and work out what the economy is

going to do can be tricky because it seems to change every week. Once upon a time, we were the highest growing country in the G7 nations - but not anymore. A new global forecast

has predicted that the UK won’t do quite as well as was hoped during the next few years, which is a definite sour note.

Watching people try and work out what the economy is

going to do can be tricky because it seems to change every week. Once upon a time, we were the highest growing country in the G7 nations - but not anymore. A new global forecast

has predicted that the UK won’t do quite as well as was hoped during the next few years, which is a definite sour note.

From Top Dogs to Cause Of Concern

Once upon a time, specifically just a few short months ago, the UK was set to grow the most out of the G7 nations - a group of countries and powers consisting of the UK, USA, Canada, Germany, Japan, Italy, and France - as we’d been one of the first to emerge from the pandemic and that offered up encouraging projections for the future.

However, new reports on the matter seem to showcase that the UK will not be the fastest-growing member of the group and, in 2023, will be the slowest.

A Country on the Edge

The UK economy is predicted to grow a little less than we’d like this year - down to 3.7%. This is a radical shift from the 4.7% that was expected in January. Ultimately, the problem boils down to the usual culprits - pressures on prices will slash spending, and rising internet rates are putting off investment.

In 2023, the situation looks even bleaker. We are projected to have the slowest growth out of the G7 countries. Our expected growth for that year is just 1.2%, which is down from the 2.3% figure we saw before.

Within the global tables, we’re actually predicted to have one of the slowest growths - excluding Russia, which is obviously being heavily sanctioned right now.

The biggest problem that experts have located is the high levels of inflation. It’ll mess with growth in 2023, but it’ll also start to impact the income of people, as the spending power we all have will go down a bit.

While inflation is expected to peak at 9% during the latter half of 2022, there is no denying that these inflation rates are going to damage the UK during 2022 and 2023, which is a problem.

There are plenty of government policies in place which will reduce the investment made by businesses as well, such as stopping a lot of tax breaks.

Final Thoughts

So, it’s not difficult to see that things aren’t going to look all that great in 2022 and beyond. Unless we see some radical - and increasingly unlikely - change, it’s not going to be easy to change the bleak projections we’re seeing so far.

The consequences of our current financial hardships will echo through the next few years, and it does create a knock-on effect - imagine dominoes for the best metaphor. Ultimately, when one problem starts, it sets up a few more in the future, which sets up more after that. We’ll need to see some stronger months to try and change course, but for now, hold on tight. It might get a bit messy.

Anna’s blog: The Budget at a Glance - What You Need to Know

So obviously, the official budget given by Rishi Sunak

recently has been the talk of economists across the country. Given the rising cost of living, the expected fuel price hike later on in the year, and gradual concerns about the

economy, this budget was going to have to deliver quite a lot.

So obviously, the official budget given by Rishi Sunak

recently has been the talk of economists across the country. Given the rising cost of living, the expected fuel price hike later on in the year, and gradual concerns about the

economy, this budget was going to have to deliver quite a lot.

In many respects, it actually did quite well. What we got when it came to the budget was a series of announcements that would theoretically help people with life everywhere, so let's recap them.

Fuel Duty Cuts

The first big announcement that was made was the cutting of fuel duty. For the first time in a while, and the second time in only 20 years, fuel duty was cut by 5p per litre starting from the day of the budget.

Obviously, this will help people in the long run, as it means that people can save money on fuel costs. This has been a considerable concern for a while, as the latest conflict in Ukraine, coupled with diminishing resources, meant that the price of fuel had been steadily rising for a while.

National Insurance Reductions

However, the thing that made people the happiest was a reduction in the amount of national insurance people have to pay. How national insurance works is that you pay your taxes, but you also pay what is called national insurance, which directly contributes to things like the NHS and public services.

National insurance costs begin after you earn £9000 or so. However, the budget saw this threshold be raised to be consistent with income tax. This means that people don’t have to pay national insurance contributions on the first £12,570 that they earn.

Obviously, this is excellent news and will help save people money all across the country. The rules come in from next year so that the next tax year will be much easier.

The Impacts

So, it’s clear that the budget was delivered with a goal in mind, and that was to try and help the rising cost of living that many people are facing. Opponents of the Conservative government have criticised the budget as not doing enough, but only time will tell as to how this will impact the economy moving forward.

Final Thoughts

Hopefully, these changes will help properly put together some respite for people.

Ultimately, these are positive changes, but they may not be enough. We’re going to have to wait and see how the economy develops over the next couple of months and how people's lives change as a result of the new rules and announcements. We can only hope that this makes things easier, as has been promised, but it’s just going to be a case of wait-and- see. After all, the future is not written in stone. We may well find a period of economic growth, so it’s essential to try and stay optimistic.

Anna’s blog: 2022 Gets Strong Start as Economy Bounces Back

It’s always lovely when the economy manages to bounce

back following a rough patch. We’ve had to take a lot of the economic news in the UK on a week-by-week basis. It has been challenging, but we might be due some good news at last.

It’s always lovely when the economy manages to bounce

back following a rough patch. We’ve had to take a lot of the economic news in the UK on a week-by-week basis. It has been challenging, but we might be due some good news at last.

The economy has grown in the period leading up to February 2022, with January being a solid month. This puts us in a stronger position than we thought and means that hopefully, good things may continue.

Increases For January

The main point that we want to convey is that we have seen a substantial period of economic growth for January. It was predicted that we would only see a 0.2% increase in the economic growth for the month, but the figure we got, in the end, was higher - 0.8%.

Naturally, this is excellent news. Growth in the economy is a valuable part of the recovery process, and the UK has needed a bit of good news for a while now.

The amount of growth that we could achieve as a population was questioned for a while. The consensus is that when it comes to our overall activities, there are a lot of different factors to consider. The effect of the war, supply chain issues, increases in national insurance, inflation - many various factors all played into things.

Hope for the Future?

It’s important to remain cautiously optimistic. Yes, there has been growth that was beyond projections. However, we’re a long way from achieving equilibrium.

2022 will be a challenging year for people - there is no way around that. We’re seeing a period where there will be more challenges, and a hike in energy bills will affect a lot of people in a significant way. We’re just at the start of a challenging year, and the impacts of that will be hard to work out.

However, that doesn’t mean that all hope is lost. There is strong evidence that we can move forward - growth of this level above projections is no bad thing.

The big question that many people now face is whether or not we can continue this growth going forward. It is hard to know if the UK can continue to grow, especially considering that cases of the virus are now finally starting to rise again.

Final Thoughts

It’s all up in the air right now whether this incredible growth that we saw as part of January is sustainable. There are plenty of situations where change like this can make a lot of difference to a problem, but ultimately it depends on whether or not there are positive results from the process.

At any rate, it is nice to see a level of growth and progress going on at the moment. We love to see a situation where the UK does manage to get better, and it’s often accomplished via economic growth, so long may it continue.

Anna’s blog: UK Inflation Raises Debt Payments

The pandemic is continuing to unveil hidden impacts on our

economy. It’s fair to say that the UK has had a rough ride regarding COVID-19; we’ve experienced high case levels, severe financial impacts, and a slow recovery.

The pandemic is continuing to unveil hidden impacts on our

economy. It’s fair to say that the UK has had a rough ride regarding COVID-19; we’ve experienced high case levels, severe financial impacts, and a slow recovery.

Unfortunately, the latter continues to become an issue, as the latest reports indicate that government interest payments have shot up due to rising inflation. Let’s take a look at the details.

New Levels of Interest

Payments made because of interest reached an eye-watering £6.1bn in January. The amount is the highest we’ve seen since April 1997 - and also an increase of £4.5bn in 2021.

The payments are thought to be because of the Retail Price Index (RPI) measurement for inflation. The final figure was 7.8% in January.

While it is true that the interest payments in January are the highest they’ve been in years, they still fell below the current most elevated levels of £9bn, which took place in June 2021.

Some will argue these increases are inevitable, and others will point to the mishandling of the pandemic.

What Does This Mean?

So, what do these increases mean for the general public?

We’re seeing a lot of challenges that can make life more challenging. Dealing with interest and inflation is one of the major headaches for the public.

It does mean that life will get more complicated when we don’t have the necessary support in place to pay back interest. Wages aren’t rising to meet inflation which means that for a lot of people, there’s not enough cash to go around.

We’re once again living and surviving in a period of economic uncertainty. Even if we manage to correct the problems and repair the damages from COVID-19, what happens if the disparity between wages and bills continues?

The economy isn’t doing well, and 2022 will be a test. There’s the energy bill increase, the recent end of self-isolation which curbs sick pay for coronavirus-related absences, and other factors.

Functionally, correcting this problem falls on the government once again. They need to try and tackle the issues by providing support for the most vulnerable parties.

For many families, these interest payments make the difference between either side of the poverty line. There needs to be some relief for people and a way to make sure that ordinary folks get a chance to prosper even in the face of adversity.

Final Thoughts

So, the rising interest payments are part of a growing problem, and it is safe to say that the economy will suffer as a result.

The end problem that many people face is a simple lack of funding and the ability to do anything with the issues met. We need a more robust support package on board to make all the difference.

The government will probably have to review a lot of their policies to make the changes we need. However, the common theme with all the news is that people will need to brace for a difficult period.

Anna’s blog: UK Economy Hits Back

We’ve recently had the latest stats come in for 2021 regarding

the economy, and it’s safe to say that we’ve done well.

We’ve recently had the latest stats come in for 2021 regarding

the economy, and it’s safe to say that we’ve done well.

The economy has done a pretty good job at bouncing back over the last year despite the lockdown, and it is refreshing to see, considering we’re in a period of uncertainty with everything.

So, let’s look at what’s gone on and how it might indicate future events.

Growth, At Last

The first thing that we can note about the economy in 2021 is that it grew. That’s good, no? We’re always happy to see some success considering the absolute state of things at the moment.

There was a 7.5% growth in 2021, which is, surprisingly, the best growth we’ve seen in the country since WW2.

Now, of course, it’s essential to make sure that we remain somewhat optimistic about things, but at this point, any economic growth is a good thing.

A Glimmer of Hope

When it comes to the economy, it isn’t easy to track how it’s doing from one day to the next. It seems like we get conflicting reports every week about the economy collapsing or flourishing, and it’s difficult to put together a cohesive sense of what’s going on.

The facts from 2021 do offer a relatively cohesive sense of how the economy actually performed last year. It gives a better sense of where we are as a country, and it’s much- needed data to try and chart a course in the future.

Will the Future Be Bright?

Ultimately, trying to predict what the future will do is never a reliable thing. In fact, it’s frequently difficult to work out, but that doesn’t stop people from trying their best.

There are many who will now say that we’re in a strong position to move forward, and that’s not an unreasonable conclusion. Strength usually follows strength, assuming that we keep making intelligent decisions, and the pandemic is winding down slowly.

However, there are still other things to consider in the equation, like the growing energy bill crisis, which is important to keep in mind. That may affect the spending power of the general public.

Ultimately, it’s hard to say for definite, but we did come out in a better place than we thought. The best economic growth since WW2 isn’t a bad accomplishment by any means and goes to show that maybe the economy is in better shape than we thought.

Final Thoughts

So we’re definitely in a stronger position than before, which is nice. The economic growth of the UK is definitely encouraging, and it is important that we continue to move forward.

At the end of the day, it’s important to take a look at what’s on offer in terms of the future. There are important steps to take when it comes to recovering the economy further, but at the end of the day, we won’t know for sure. It’ll just be a case of waiting for things to figure themselves out, and hopefully, everything will progress smoothly.

Anna’s blog: What Does the Energy Bill Rise Mean For You?

If you’ve been paying attention to the news this week, then

you will know that there has been quite a lot of talk about the increase in energy bills.

If you’ve been paying attention to the news this week, then

you will know that there has been quite a lot of talk about the increase in energy bills.

It’s difficult to say whether the COVID-19 pandemic has contributed to this, but we are now dealing with a rise in energy bills for families all across the UK.

In the interest of making sure that you understand what’s going on, we thought we would look at what the energy bill rise will mean for you.

The Increases

From April 2022, there will be an increase in the amount people have to pay for their energy bills. This covers things like gas and electricity, and the estimated annual increase is £693 per household.

Now, when you factor in that the bills are typically split over a 12 months to six months, The costs are a little bit less. It works out just under an extra £50 a month over a 12 month period, or £100 over a six month period. However, that’s not the point.

The big problem is that we are in the middle of an economic recovery, and a lot of people don’t have this extra money. When you factor in that the cost of living is already going up, you get people who are going to have to balance heating their homes versus being able to eat.

The Government Solution

The government has acknowledged that this is potentially untenable for some people, which is why they have tried to help where they can. As a consequence, there is financial support available.

There is a £200 energy bill rebate which will be available, and also a £150 council tax rebate for any households that are in the A to D bracket of council tax payments in England. It’s estimated that these brackets make up 80% of all British homes.

The Effects

The effects that are going to make themselves known over the next six months are just going to complicate life for a lot of people.

Presumably, this decision to raise energy bill prices was taken as a last resort. However, that doesn’t change the fact this is far from the optimal outcome for anybody.

Hopefully, the prices will go back down in 2023, but 2022 could be a pretty tricky year for quite a few people. For some, it will be the difference between either side of the poverty line.

Final Thoughts

So, the energy bill increases will affect everybody. It doesn’t matter who you are at this point; you will be affected in some fashion. Most of us, the vast majority, will have to pay a bit more.

However, the people who will be most affected by this are those who are straddling the poverty line. Hopefully, the government will introduce more robust assistance for those people because there are going to be a lot of families who can’t handle this price increase.

For now, it’s just a case of trying to prepare for the bad times that are coming. Hopefully, the economy will start to see better days soon enough.

Anna’s blog: National Insurance Tax Still Set to Rise

In the past we’ve talked about the economy in a general sense -

these things may not have much impact on you as an ordinary person, but this update will affect people.

In the past we’ve talked about the economy in a general sense -

these things may not have much impact on you as an ordinary person, but this update will affect people.

After some debate and speculation, the national insurance (NI) tax we all have to pay as part of our standard taxes is going to rise at this moment. It’s important to recognise how this will affect people and what it means for the economy.

Why is the Tax Rising?

So, the tax is being raised to try and provide more support for the health and social care areas of society.

It is no secret that the NHS has been underfunded for years now - for a Public Health Service a surprising lack of funding has been given to it. The government is now trying to patch up the holes in the funding, especially after it has been highlighted immensely during the pandemic.

The increase in national insurance tax is designed to try and deal with the problem, and it is going to be an effective way to deal with the lack of funding, but it will mean that most of us will wind up paying a little bit more than we thought we would.

How it Will Affect You

Like we said, it will have an impact on people from all different walks of life. National insurance is defined by income. So, the more that you earn, the more that you have to pay.

Its estimate of the people who make £20,000 a year will have to pay around £150 extra, and this will scale up and down depending on your income. So, if you earn a lower amount, then you’ll have to pay a little bit less extra, but if you want more, then you pay more.

If you’re already employed, then you may not see much of a difference in your wages. Taxes are automatically deducted before you get your payslip for the months, so it’s likely that you won’t see masses of change besides an extra £20-£30 being taken out each month.

For the self-employed, this will mean making sure that you save up a little bit extra for your tax bill. Once you file a tax return for 2021 to 2022, you will be able to see how much you have to pay, and then you’ll have till the 31st of January 2023 to pay it.

Final Thoughts

So, the national insurance tax increase is going to be something to keep an eye on. It’s not necessarily the end of the world, but it does require a little bit of care to get the best results. Ultimately, you will just want to make sure that you save up as much as you need to if you’re self-employed, but otherwise, there isn’t much you need to do besides sit back and watch the taxes automatically be deducted. Hopefully, these increases will help to fund the NHS and our social care projects, and mean that the economy starts to get into a healthy shape again.

Anna’s blog: Inflation Finally Reaches 30 Year High

Well, at this point, it’s not really surprising that it has

come to this. The rise in food prices has finally tipped us into the highest raise of inflation that we’ve seen in 30 years.

Well, at this point, it’s not really surprising that it has

come to this. The rise in food prices has finally tipped us into the highest raise of inflation that we’ve seen in 30 years.

Naturally, this doesn’t bode well for the economy, but it is important to understand what has happened, what could happen, and what is most likely going to happen.

So, without much further delay, let’s take a look at inflation reaching a record high and seeing what it does.

Rising Bills

So, what is to blame for the rise in inflation?

Well, it is a combination of both rising food costs and then a concurrent rise in energy bills.

These changes drove inflation up to 5.4% in the last 12 months leading up to December, which was up from 5.1% in the previous month.

As previously mentioned, this culminated in a 30 year high in terms of inflation. The last time this was such an issue was March of 1992, when inflation was at 7.1%.

Concerningly, this could all happen again, as gas and electric costs are all set to go up in the spring, which means that things could well become as bad as it was in 1992.

What Can Be Done?

The first and most obvious question that a lot of people will have is whether or not anything can be done about the problems, and it seems on the surface, there isn’t.

Up until now, we have seen energy bills kept relatively manageable by the price cap set by the government. However, as this is due for revision in April, the solution is only temporary.

There isn’t much we can do, irritatingly - it is mostly going to be a case of battening down the hatches and weathering the storm. It could be a long storm as well - we may not see a return to better inflation rates until 2023.

A Rough Future Ahead

So, the future might be rough ahead but we can achieve a degree of optimism knowing that it’ll pass eventually.

We’re looking at a year of rising prices and challenges, and it will take a pretty high level of resilience to make it through. Hopefully the government will introduce more schemes and ways to support us, because if we are going to thrive, it’ll have to be with the help of support networks.

Final Thoughts

The rise of the inflation for the economy is definitely cause for concern, and it does make us struggle to maintain optimism during the next year.

This is perhaps one of the more obvious consequences of the pandemic, or perhaps simply a natural part of society progressing forward - it’s hard to tell. Government support will make such a difference to our success as a country, and we’ll just have to take things one day at a time. We will continue to provide you with as much support as we can, and make sure you have an up-to-date knowledge of what’s going on.

Anna’s blog: UK Economy Above Pre-COVID Levels

It certainly seems like each new week brings a new take on the

economy. We seemingly move from chaos to growth in a matter of days, and perhaps this is because the economy is in a state of flux right now.

It certainly seems like each new week brings a new take on the

economy. We seemingly move from chaos to growth in a matter of days, and perhaps this is because the economy is in a state of flux right now.

The coronavirus pandemic has economic repercussions which we will not understand for many years, and it is impossible to predict what will happen. The logical guesses made by economists seem to be accurate some of the time. Right now, the economy is in a strong place, but how long will that continue?

Growth At Last?

So, what we are seeing is that the economy has finally managed to get past the pre-covid levels for the first time in November of last year.

According to The Office For National Statistics, growth was at 0.9% for the time between October and November.

This amount was actually higher than what the economists predicted, and it meant that the economy as a whole was 0.7% bigger than it had been in February of 2020, which was when the pandemic really began to come into prevalence.

What Does This Mean?

Once again, we are back asking the question of what it all means. Ultimately, this is a positive thing. It does mean the economy is at a higher level of growth than was predicted, which means that we could come out of the economic crisis that has developed as a result of a pandemic sooner.

At the same time, it’s hard to tell these days. Everything is in such a weird state of flux, because each week seems to bring new information about the effect the pandemic had on the economy, so we’re just trying to see if there is a pattern emerging in the data, or if there is a trend in terms of progress.

Ultimately, we are not dissimilar from economists, or the financial experts, or the business owners, in a sense that we’re just trying to make some kind of sense of what’s been going on for the last year or so. It’s hard to tell what kind of lasting impact the economy will have in terms of the pandemic, so we’re just waiting at this point.

The biggest problem is that there’s never been a crisis like this before. We haven’t had a pandemic this severe in recorded history, so tracking the damage is really difficult. There is no manual for this.

Final Thoughts

So, at the end of the day, we appear to be in maybe a stronger position than we thought. Obviously, it’s just going to be a case of reporting on the new findings and data as it comes through, and maybe we can start to put together some kind of pattern, and figure out exactly what’s going on. It might take time, but we are committed to bringing you the news every week, and hopefully, we can all figure out where the economy is going together.

Anna’s blog: Inflation and Product Shortages to Blame For Stalling Economy?

Well, we’re into 2022. It’s safe to say that things could

be going better. The economy is currently stalling a bit, and it’s not looking too promising for the month ahead.

Well, we’re into 2022. It’s safe to say that things could

be going better. The economy is currently stalling a bit, and it’s not looking too promising for the month ahead.

Why is this the case? What has caused the economy to effectively grind to a halt? Well, there’s a couple of different theories, and it’s probably important to look at all of them if we’re going to work out what’s going on. However, it all boils down to two things. The rise of inflation, and product shortages.

Plan B in the Way

Plan B was the initial attempt by the government to try and mitigate some of the damage that would be caused by the latest variant of the coronavirus. However, it has had a bit of an adverse effect on the economy.

The problem looks a little bit like this. Because Plan B curtailed a lot of the shopping that people would’ve normally done over the Christmas period, sales in the fourth quarter of 2021 have not been as successful as people would’ve liked. This makes a 2022 spring to summer expansion a lot harder.

Where Does Blame Go?

So, where do we put the blame for this setback? Well, depending on where you go, you’re going to get a different opinion. There are some people who put the government solely in the crosshairs, but others in the retail and economic sectors will point to rising inflation and a reduction in products being imported.

The likelihood is that it’s actually a combination of all three, and the end result is that we are struggling quite a bit to really get going in the way that was hoped in the beginning of 2022.

Obviously, people were optimistic at the end of last year that 2022 would be the year that we would break away from the lingering effects of the coronavirus, and start to recover the economy. However, that’s not necessarily the case.

Instead, we have kind of fallen into the trap of stalling a little bit. It’s become quite difficult to keep tabs on the state of things, but we’re not quite moving forward with the momentum that we wanted to at this point. Hopefully things will clear up, but for now, it’s all gone a little bit pear-shaped.

Final Thoughts

So, 2022 may not have been the roaring success that we wanted it to be. However, we are just approaching the beginning, so there is every possibility that we can recover from this slump. After all, we're only just in January, so there’s plenty of time for things to pick up, and a summer return might well be in the cards. It does depend on a few things, like for example whether or not we can get past this influx of Covid cases, but it’s important to try and be optimistic. We have to recognise that the country has been in some pretty dire straits recently, so it’s not necessarily going to be instant progress.

Anna’s blog: UK Economy Set to Outgrow Other Countries in 2022

When we look at the British economy, it’s generally in the

context of what’s going on within the country. However, there is something to be said for how the British economy is doing in comparison to the rest of the world, because everybody

is in the same boat at this precise moment, and the countries that recover quickest from the pandemic are the ones that will thrive.

When we look at the British economy, it’s generally in the

context of what’s going on within the country. However, there is something to be said for how the British economy is doing in comparison to the rest of the world, because everybody

is in the same boat at this precise moment, and the countries that recover quickest from the pandemic are the ones that will thrive.

Recent predictions by economists are positive for the UK economy when we look towards 2022. In fact, we are set to outperform every other G7 country during the year in terms of economic growth.

What Are G7 Countries?

to understand what’s going on, we do have to acknowledge that not everybody will know what a G7 country is. The G7, known as the Group of Seven, is a political forum consisting of governments from seven countries. The United Kingdom, the US, Japan, Canada, Italy, France, and Germany all make up this roster.

Estimated predictions by economists suggest that we’ll see a 4.8% growth in GDP over 2022, which makes the UK set to be the dominant force in this arena.

What Will This Mean For Our Economy?

So, what will something like this mean for the economy in terms of how life will feel for us?

Broadly speaking, we can probably expect to see a lot of economic growth. These predictions are primarily geared towards the recovery from the pandemic, and a larger economic growth suggests that we’ll be one of the first to come out of the pandemic and thus, one of the fastest to get back to a better place.

Obviously, this could be a good thing for the everyday worker, because it could suggest that we’re moving into a period of positive economic growth. Hopefully, we’ll see interest and inflation either remain where they are or decrease, and the new increases in wages should help to make things a bit better.

However, it is important to acknowledge these are just predictions and projections - they don’t necessarily point towards a future written in stone. Anything could happen in the future, and we don’t know how well any country can do. You might find that Japan or Canada experiences a surge in growth, and if that’s the case, then everything is up in the air.

Final Thoughts

So, the current projection is that we’ll do quite well in 2022 and this is good news for companies and people alike. It’s always exciting to see how the economy will adjust to some of the challenges of the upcoming year, but for the time being, it seems to be a positive growth. Outperforming all G7 countries would put us in a strong financial position, so it’ll be important to see how everything plays out and what this means for the country as a whole. It’s going to be important to approach 2022 with cautious optimism at this point, because we don’t know how things will play out until later.

Anna’s blog: No New COVID-19 Rules In England Before New Year Offers Hope For Economy

For a lot of the economy, the last week has been a tense one.

Rumblings of a lockdown or severe limits on public activity have suggested issues for areas like retail and the hospitality industry - aspects of the economy which thrive over the

festive period.

For a lot of the economy, the last week has been a tense one.

Rumblings of a lockdown or severe limits on public activity have suggested issues for areas like retail and the hospitality industry - aspects of the economy which thrive over the

festive period.

However, the recent announcement by the government has offered a brief respite for these industries in England. Following on from some encouraging news about the new Omicron variant itself, we might be in a stronger position than initially thought.

England Escapes New Rules

As we said, it’s been a little bit of a tense week or two for the economy as the verdict from Number 10 would either spell doom for many industries or let them stay open and take in some much needed cash.

The result was positive for these industries - despite the spread of the virus, there would be no changes to the rules before New Years Eve. This means that retail, hospitality and any other industry can stay open for the biggest days of the holiday - Christmas Eve, Christmas Day, Boxing Day and New Year's Eve.

Obviously, this is a great way to bring in some health to the economy, and means that even if there are restrictions afterwards, people can still try and pick up their goods or go out for meals when it counts.

Omicron Less Severe?

Another interesting development that we have seen during this week is that Omicron seems to be less severe than first thought.

A recent study conducted seems to suggest that this variant is 40% less severe than other strains of the virus that have come through the UK. A popular theory, albeit one not yet backed by medical fact, is that with each new mutation, the virus is growing weaker in severity, which is a positive.

This news has obviously made people a little more optimistic about the future of COVID-19. If the virus isn’t as severe as other mutations, then what comes after it might not be as bad as other variants that crop up?

If that’s the case, then the overall number of restrictions that come from this will go down, which means that there is a far less likely chance that people will experience financial hardship to the same degree we saw in 2020-2021. Ultimately, this can only be good news for the economy, even if it takes a little time to get going.

Final Thoughts

For now, however, happy holidays to all of our readers. Your support this year has been exceptional, and for 2022, we aim to do as much as we can. Remember to stay safe, follow any rules the government does produce in the next few weeks, and enjoy the New Year!

Anna’s blog: Interest Rates Increase For First Time Since 2018

The economic consequences of COVID-19 are still making

themselves known, with even the best experts unsure as to how the country will fare in the coming years. Unfortunately, we’re already beginning to see the impacts of the pandemic.

The economic consequences of COVID-19 are still making